Stopping Foreclosure in Los Angeles Today!

Are you facing the threat of foreclosure on your home? The thought of losing your home can be scary and stressful but there are ways of stopping foreclosure in Los Angeles while protecting your credit score from ruin and preventing a foreclosure on your record for 7 years.

Are you facing the threat of foreclosure on your home? The thought of losing your home can be scary and stressful but there are ways of stopping foreclosure in Los Angeles while protecting your credit score from ruin and preventing a foreclosure on your record for 7 years.

First Educate yourself as to all options available

The best thing you can do is to educate yourself about the process and learn about the options and resources that are available to you. Once you know all of your options, you can then choose the best way of stopping foreclosure in Los Angeles.

What is foreclosure

Knowing how the foreclosure process works can help you navigate the process more effectively to avoid or stop foreclosure. So what exactly is foreclosure? Foreclosure is a situation in which a homeowner is unable to make their principal and/or interest payments on their mortgage, so the lender, be it a bank or private party, can seize and sell the property as stipulated in the terms of the Deed of Trust.

What most people don’t usually understand is that when a borrower defaults on their loan, the bank can’t just take the property from the homeowner. In non-judicial foreclosure states like California, the right to start the foreclosure proceedings lies with the trustee. The trustee is a neutral 3rd party who is responsible to both the lender and the borrower. It’s the trustee who has the right to start the foreclosure proceedings and ultimately sell the property at auction.

Watch The Short Video Below for Options For Stopping Foreclosure in Los Angeles

Know the timeline

Foreclosure can start as soon as one day after the first payment is late but typically it doesn’t start until several payments have been missed. This depends on the lender, some being more strict than others. Before starting the foreclosure process, the lender usually sends out many notices to the homeowner that payments are overdue.

This is often referred to as Pre-Foreclosure which is the preliminary stage of the foreclosure process, before legal filings are made by the lender. This is the optimal time for stopping foreclosure in Los Angeles because at this point your credit rating will not seriously be affected.

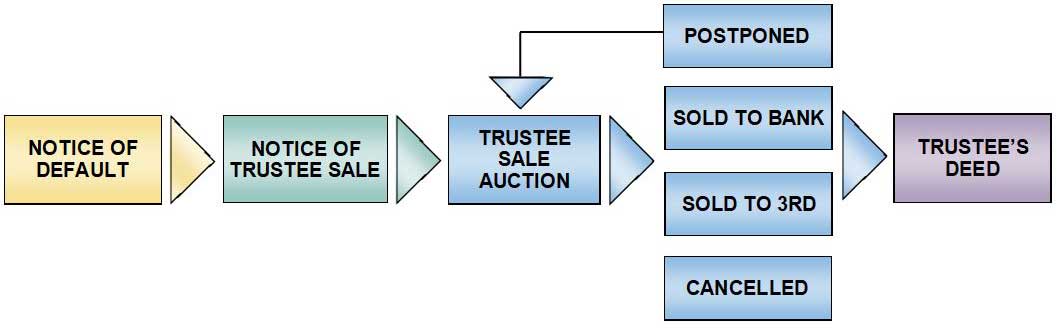

The Foreclosure Process from Start to Finish

Below is a simple chart showing the basic stages in a Non-Judicial foreclosure from start to finish. Each stage is explained in more detail in the sections that follow:

Notice of Default

Foreclosure begins when a Notice of Default is filed. The lender informs the trustee that the homeowner is in default on the terms of their loan which is stated in the loan documents. Then, the trustee will record a Notice of Default (NOD) and will mail it to the last known address or personally serve the Notice of Default to the borrower, if required. From the date that the NOD is recorded, the borrower has a minimum 90 days in which to dispute this with the lender or bring the loan current. During this time, you can certainly work with them to make up the payments or find another resolution. CC2924(a)(1)

However, be aware that at this point, the lender will only accept full payment of all that is due, including late fees, before stopping foreclosure in Los Angeles and preventing the property from going to auction. They cannot accept partial payment at this point for legal reasons.

Notice of Trustee Sale

After the notice of default has been received by the owner and the 90-day period has passed, if the homeowner has not made the loan current or arraigned something with the bank, the trustee will move forward with scheduling the sale. A Notice of Trustee Sale (NTS) will be filed which sets forth the auction date, time and location which can be no sooner than 21 days from the date the NTS was recorded. CC2924(a)(3)

As you can see, the foreclosure process can move quite rapidly. Once the Notice of Default is filed, you have 90 days to find a solution. The closer you get to the sale date, the more limited your options are, which is why it’s imperative to try and resolve this as early in the process as possible.

Take the First Step, Call Your Lender

When homeowners are behind on their mortgage payments, their first instinct is to stop answering the phone and hide from their lender. This may not be the best strategy.

When homeowners are behind on their mortgage payments, their first instinct is to stop answering the phone and hide from their lender. This may not be the best strategy.

Mortgage lenders understand that problems and hardships arise in people’s lives that can lead to mortgage default. They know that most homeowners don’t usually intend to default on their mortgage but for a variety of reasons, it’s unavoidable. The most common reasons are:

- divorce

- illness

- loss of job or reduction of income

- death in the family

- high adjustable interest rate that is increasing

Believe it or not, lenders would prefer not to start foreclosure proceedings. If you will contact them, they may be willing to work out something with you. Just keep in mind that their main goal is to protect their asset, which is your home.

Some things you should know when negotiating with lender

- The lender does not want to own the property. Misconception among homeowners. Lender just wants their money. Just keep in mind that their main goal is to protect their asset, which is your home.

- Must have your financial problems under control, have the ability to bring your loan current and resume your monthly payments. If you cannot afford the monthly payments, then consider other options.

- Act quickly. Don’t wait until last minute. Lenders rarely cooperate with borrowers who contact them very close to the foreclosure sale.

- Be prepared to discuss specific proposals for restructuring your loan or bringing the arrears current.

- Always keep all correspondences to and from the lender. Important to keep a paper trail.

- Make sure you are dealing with your current lender and not a loan "servicer."

- Get in contact with someone who has the authority to stop the foreclosure. Don't waste time on lower level collection person.

- Negotiate in a spirit of cooperation. Keep your emotions in check. This is no time to antagonize, yell or get angry.

- Explain your situation to the lender. Assure your lender that the cause of the default is being (or has been) resolved.

- Be truthful to your lender and don't make promises you can't keep. Do not agree to a settlement that you cannot follow and only agree to what you can really afford.

Some Possible Resolutions Your Lender Might Consider For Stopping Foreclosure in Los Angeles

Forebearance – When the lender agrees to temporarily reduce or suspend mortgage payments for a certain period of time without starting foreclosure. The borrower must resume the full payment at the end of the forbearance period, plus pay an additional amount to get current on the missed payments, including principal, interest, taxes, and insurance. The specific terms of a forbearance must be worked out with the lender. The lender will expect you to show that the delinquency was due to circumstances out of your control (injury, illness, job loss) and that the financial difficulties have been corrected. This is good if your distressed situation is only temporary and you only need a short period of time to get back on your feet. can be a way of resolving it. Payment plan. Pay arrears over the next 3,6 or max 12 months. The bank will postpone, not stop, foreclosure until all payments are made and then will reinstate the loan.

Repayment Plan – This option adds a small amount to your current monthly payments for a specified period of time until the amount of the missed payments are collected. This will work if your financial distress was only temporary and can be quickly resolved.

Loan Modification – For most homeowners, modifying or restructuring their current mortgage loan is a better alternative to foreclosure. A loan modification is a permanent restructuring of the mortgage where one or more of the terms of a borrower's loan are changed to provide a more affordable payment. If you qualify for a modification, the lender may agree to do one or more of the following to reduce your monthly payment: a) reduce the interest rate, b) convert from a variable interest rate to a fixed interest rate or c) extend of the length of the term of the loan. To effectively modify your loan, negotiations will be necessary with your lender. Your negotiation strength will be to convince the lender that they will lose less money than if they went forward with the foreclosure.

Partial Claim – With some government loans, the lender can request a partial claim which is simply a loan that is used to pay back missed mortgage payments on your behalf. However, there are certain lending criteria to meet and the loan must be repaid by the end of the term of your mortgage.

Debt Forgiveness – If you can develop a plan to be current with your loan after this missed payment, your lender might forgive or waive this missed payment. Keep in mind, however, that this option rarely happens.

Most common complaints/issues homeowners face when trying to deal with the bank:

- Must be able to document their income. If you have no income, you're not going be able to get any help.

- Change in payment doesn't always mean that it will go down. E.g. lower interest rate but higher principle balance

- Process very cumbersome. Every call takes at least 30 minutes. Bounced around from dept to dept. Not an easy process. Go to website and download app, fill it out and fax it in along with all your supporting documentation. Call us back in week. Very time consuming and time is not on their side.

- Very difficult to work with. Left hand doesn't know what the right hand is doing. Trustee handles, Home retention dept, bk dept, fc dept

No Luck Stopping Foreclosure in Los Angeles with your Lender? There is Still Hope!

Of course, if the lender won't work with you and you're unable to stop the foreclosure... your options are a bit more limited... but there is still hope to save your credit rating, save you money, and get you out of your situation without hassle.

We’ve been dealing exclusively with people in Foreclosure since 2003 and we’d like to offer you our assistance by looking at any alternatives that you may qualify for.

We will do a FREE Evaluation of your situation

We will put our 10 YEARS of experience to work for you! We will look at all the alternatives that you aren’t currently working on, haven’t already considered or realized are available to you.We don’t need much more information than is already available

All the information we need is public record. We won’t run your credit or need any personal information.It only takes us 24 hours to complete

When we’re done, we can tell you if there are any solutions you qualify for. If you’re interested in any of them and want to discuss them further, we’d talk with you and answer all the questions you may have.

We can evaluate your specific situation for you to lay it out in clear to understand terms exactly which options are realistic and exactly what each option can do for you and your family. Just get a hold of us and tell us a bit about your property... from there we'll get back to you within 24 hours with a clear explanation of what will help you reach your goals in your specific situation.

If you are already in default, it’s in your best interest to consider all the possibilities that may be available to solve your problem. Call us for a professional opinion. The only thing you have to lose is a few minutes of your time.

We will run a Free Analysis of the property...and see what options are available.

Call Us Today: (818) 392-4845 or...

Fill Out This Form

Download Our Free Foreclosure Guide

Need more information on the foreclosure process and For Stopping Foreclosure in Los Angeles? Download our FREE Stop Foreclosure Guide here. Or, you can always feel free to Contact us anytime if you have questions, want a no hassle Situation Evaluation, or want to just learn more about how we can help homeowners avoid or stop foreclosure in Los Angeles.

Need more information on the foreclosure process and For Stopping Foreclosure in Los Angeles? Download our FREE Stop Foreclosure Guide here. Or, you can always feel free to Contact us anytime if you have questions, want a no hassle Situation Evaluation, or want to just learn more about how we can help homeowners avoid or stop foreclosure in Los Angeles.

The bottom line is that you don’t have to sit back powerless while your house and your happiness slips away from you. We can help you take back control of your situation and your life!

In most cases, we can stop foreclosure from happening because, as you know, a foreclosure on your record can ruin your credit for up to 7 years, making it difficult to get another house, car, credit card, or any type of credit whatsoever.

Every individual situation is unique and personal, and finding the best solution depends on your particular problem situation.

Please contact us at (818) 392-4845 for a FREE Evaluation and Assessment as well as to discuss which options are best for you. If you need more information on the foreclosure process and for Stopping Foreclosure in Los Angeles? Download our FREE Stop Foreclosure Guide here.