Avoid Foreclosure in Los Angeles Today!

Are you behind on your mortgage payments and are trying to avoid foreclosure in Los Angeles? We specialize in pre and post foreclosure resolution. The best advice we give homeowners in distress is to look at all the options available. Only by first becoming aware of all your options can you then decide what is the best course of action to take to resolve your problem situation.

Are you behind on your mortgage payments and are trying to avoid foreclosure in Los Angeles? We specialize in pre and post foreclosure resolution. The best advice we give homeowners in distress is to look at all the options available. Only by first becoming aware of all your options can you then decide what is the best course of action to take to resolve your problem situation.

Unfortunately, we see too often homeowners focusing all their efforts on one solution and have no backup plan when it fails. Sadly, they run out of time and lose their home to foreclosure. They don’t realize that there are solutions to resolve their situation that most accountants, bankers, friends, attorneys, and real estate agents are not aware of.

It is important to educate yourself on how the foreclosure process works in California. Then you will have a better understanding of what options are available to stop or avoid foreclosure in Los Angeles.

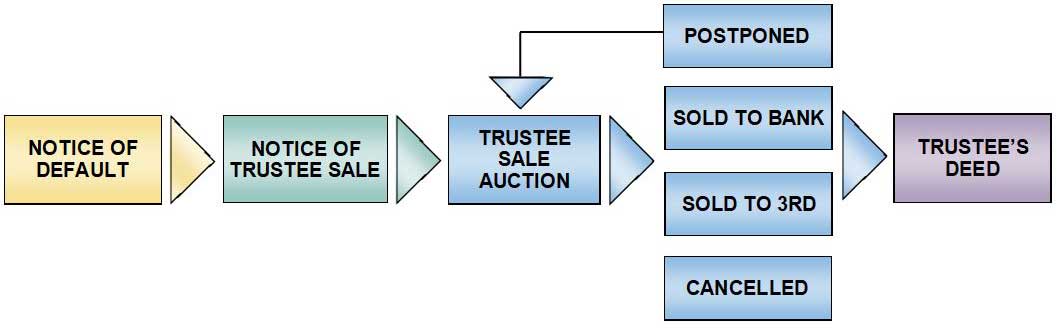

How the California Foreclosure Process Works:

Contrary to popular belief, banks can’t just take back a property when an owner stops making payments. In Non-Judicial Foreclosure states like California, the right to foreclose and sell the property actually lies with a 3rd party, known as the trustee; who has a fiduciary responsibility to both the lender and the borrower.

Overview of the California Non-Judicial Foreclosure Process:

Notice of Default

The foreclosure process starts when the lender notifies the trustee that the owner is not paying their loan, as agreed. The trustee will then issue a Notice of Default. This notice provides the borrower with a period of time (3 months in California), in which to either dispute the lender’s claim that the borrower has defaulted, or to pay it current prior to the house being sold.

Notice of Trustee Sale

Once the owner has received the notice of default and has been given an opportunity to bring the loan current, the trustee will proceed with scheduling the auction date and time if the owner has not yet brought the loan current. The Notice of Trustee Sale sets forth the auction date, time and location.

Trustee Sale Auction

On the date and time of the trustee sale auction, one of four things may occur with the property:

- Postponed — The auction may be postponed to a later date and time. Common reasons for postponement include: mutual agreement between borrower and lender; beneficiaries request, where the lender decides to postpone the sale; trustees discretion, where the trustee decides to postpone; bankruptcy, which actually doesn’t completely stop foreclosure, but instead puts a temporary stay on the sale; and operation of law, where a court has ordered that the sale not be held.

- Sold To The Bank — Since the lender clearly has the most to lose in the transaction, and because they are the beneficiary of any funds received from the sale, they are allowed to place the first bid up to the amount they are owed.

- Sold to 3rd Party — The loan being foreclosed on was offered for sale by the trustee, and a bidder (other than the lender) ended up purchasing the loan.

- Cancelled — This may occur because the property was sold before the auction, and therefore the loan was repaid (or partially repaid in the case of a short sale); the owner was able to refinance the loan; the owner came up with the cash to bring the loan current; or, there may have been an error made in the sale process, and the trustee has decided it would be better to restart the process.

Trustee’s Deed

Once the property is sold at auction, the property has been foreclosed. Ownership of the property is transferred to the new owner (whether the bank or a 3rd party bidder) with a Trustee’s Deed, and any secured interest in the property held by junior lien holders is wiped out.

A Detailed Look At The Foreclosure Process May Help You Avoid Foreclosure in Los Angeles

Request received to start foreclosure process.

Trustee requests original documents from beneficiary (lender).

Trustee Sale Officer sets up file, prepares Notice of Default (NOD) and Substitution of Trustee, if required. Sends for signature(s).

When signed documents and deposits are received, Trustee Sale Officer sends for recording and orders Trustees Sale Guarantee (TSG) from title department which specifies what is required for a valid foreclosure, coordinating state statutes with loan documents.

Notice of Default records.

Trustee will publish, post and mail to last known address or personally serve the Notice of Default, if required.

Mails copy of Notice to those entitled within 10 business days.

TSG received, Checks for errors.

Mails copy of NOD to persons entitled within 1 month.

Sends authorization to publish to client two weeks before the end of the third month after NOD records.

Notice of Trustee Sale filed. 3 month period ends.

PUBLISH:

Sets sale date (4 to 5 weeks) and Publishes Notice of Sale.

MAIL:

At least 20 days prior to Sale, Officer mails a copy of the Sale Notice to the same persons that received the NOD.

EXCEPTION:

IRS lien mailings must be sent at least 25 days prior to sale. Any state taxing agency must be mailed Notice of Sale at least 20 days prior to sale.

POST:

At least 20 days prior to Sale, Notice of Sale must be conspicuously posted with a description of the property to be sold and the street address, specific location, date and time of sale. 1) at 1 public place (court house, city hall, etc.) 2) on the property.

RECORD:

Officer records Notice of Sale at least 14 days prior to sale date.

Sale Date

Military affidavit, Bid Instructions, Posting Affidavit and Publication Affidavit required before sale.

Datedown required before sale is held.

Crier of Sale qualifies bidders.

Conducts Sale.

Trustee Sale Officer records Trustee’s Deed upon sale.

Want Us to Help You Review Your Situation to Lay Out ALL of Your Options?

We Will Do a FREE Evaluation of Your Situation to Help You Avoid Foreclosure in Los Angeles

We will put our MANY YEARS of experience to work for you! We will look at all the alternatives that you aren’t currently working on, haven’t already considered or realized are available to you.

Call Us Today: (818) 392-4845 or...

Fill Out This Form

To Avoid Foreclosure in Los Angeles, Download Our Free Foreclosure Guide

Need more information on the foreclosure process and How To Avoid Foreclosure in Los Angeles? Download our FREE Stop Foreclosure Guide here. Or, you can always feel free to Contact us anytime if you have questions, want a no hassle Situation Evaluation, or want to just learn more about how we can help homeowners avoid or stop foreclosure in Los Angeles.

The bottom line is that you don’t have to sit back powerless while your house and your happiness slips away from you. We can help you take back control of your situation and your life!

In most cases, we can help you avoid foreclosure in Los Angeles, because as you know, a foreclosure on your record can ruin your credit for up to 7 years, making it difficult to get another house, car, credit card, or any type of credit whatsoever.

Every individual situation is unique and personal, and finding the best solution depends on your particular problem situation.

Avoid Foreclosure in Los Angeles Today!

Please contact us at (818) 392-4845 for a FREE Evaluation and Assessment as well as to discuss which options are best for you. If you need more information on the foreclosure process and How To Avoic Foreclosure in Los Angeles, Download our FREE Stop Foreclosure Guide here.